Feeling bored during quarantine, looking for projects to do around the house? Maybe you’re interested in how COVID-19 affects real estate prices and considering sprucing up your property before putting it on the market.

Whatever the case may be, we have you covered! Here are nine home upgrades you can do over the next few months to make your place more beautiful and valuable. We’ve broken up these ideas by category to help you find the best solution to achieve your specific goals.

Home Upgrades for a Small Space

If you’ve been cooped up inside tight living quarters during quarantine, you’re probably experiencing more cabin fever than most. It might seem impossible to make improvements when you’re working with limited square footage, but that’s not true at all—it’s totally possible to beautify a small apartment. Here are some of our top suggestions.

- Add more storage space. An area that looks cramped and cluttered feels just the same. From those old college moving boxes that you never got around to unpacking, to all the exposed cables strewn across various surfaces, try to put everything in its proper place. You’ll do your mind a major favor by eliminating the mess, so pick up a few storage bins that you can conceal beneath the couch or bed.

- Change up your color palette.

Sometimes, a fresh coat of paint is all it takes to breathe new life into a stagnant living space. If you’re feeling like you’re staring at a prison of four white, bleary walls, invest in some color therapy to lighten the mood—you might be surprised to see what an effect hues can have on human psychology! Whether you opt for a vibrant, red accent wall or go corner-to-corner with a coat of soft, tranquil seafoam green, the difference will be noteworthy.

Gallons of paint can get pretty expensive, but you don’t have to break the bank to upgrade your color palette. If the bed is the largest object in sight, consider buying a new, cozy comforter that you’ll enjoy crawling into, rather than feeling confined to. Then, pick up some matching throw pillows and decorative accents to tie the revamped scheme altogether!

- Bring the outdoors inside. Indoor plants are another great way to enhance your mental and emotional health, which is especially critical during this period of social isolation. If you can’t go outside, bring nature to you by adding touches of greenery throughout the space. Lacking a green thumb, or sufficient natural light to keep plants alive? No problem. Faux flowers and plants can achieve the same effect, minus the maintenance.

These changes may seem simple, but they can make a big upgrade to a small space in a short amount of time!

Home Upgrades that Save Money

Homeowners have endless possibilities in terms of renovations: an exterior facelift, kitchen expansion, bathroom remodel, outdoor patio… the list goes on and on. But although they’re less limited in space, there are still two constraints that can impact which upgrades they choose to pursue: time and money.

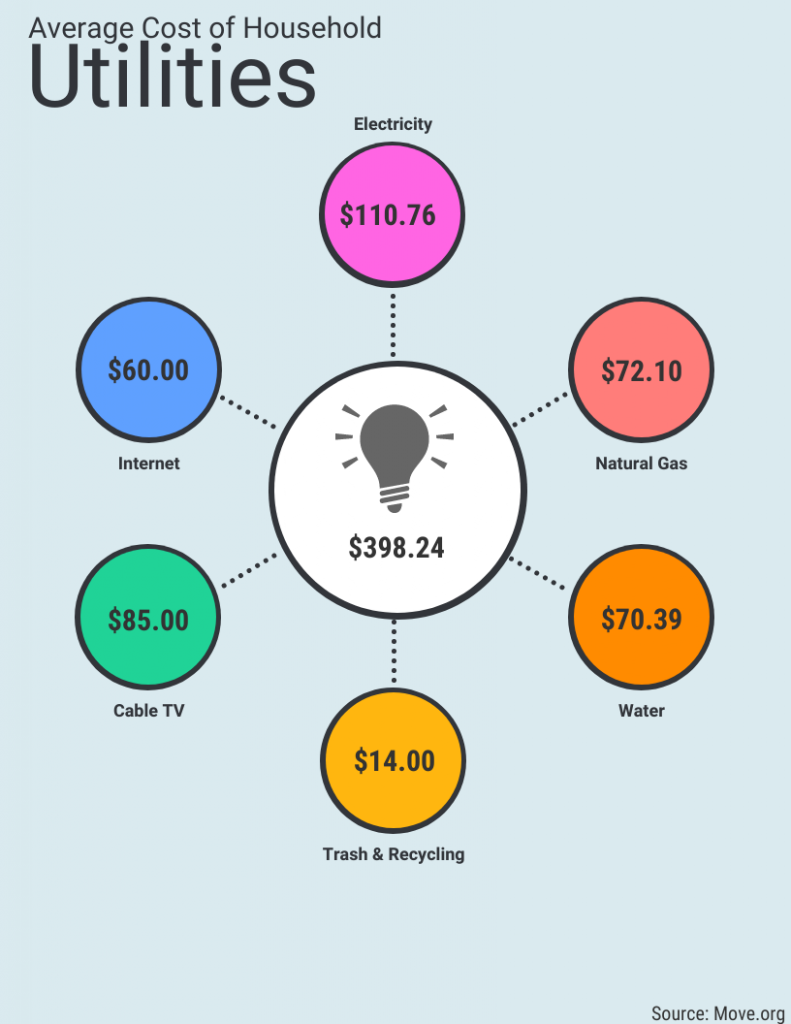

It’s essential to save money when owning a home. Otherwise, you run the risk of falling behind on property taxes, mortgage payments, and outstanding financial obligations. Those who value frugality might cringe thinking about the cost of renovation, but these energy-efficient ideas are simple and affordable—and they can actually help you save money down the road by significantly reducing monthly utilities.

- Change your lightbulbs. If it sounds easy, it is. Simply switching out your old, incandescent light bulbs with LED ones is a low-investment, high-return upgrade. LEDs use 75-80% less energy and swapping out as few as five could save more than $30 per year in electricity—but the average home has 30-60 bulbs installed, meaning you could see hundreds in savings.

- Xeriscape the yard. This big word helps reduce your environmental footprint, which then in turn reduces your water bill. Xeriscaping refers to the process of landscaping that’s designed to decrease or eliminate the need for irrigation. Swap out thirsty plants and grassy lawns with native, drought-resistant species, strategically located to cut back on water consumed by the yard and garden.

- Optimize the insulation. One of the best ways to save money is by cooling and heating your home more efficiently, and there’s plenty of options for how you can do so depending on the size of your budget. Installing smart thermostats, dual-paned windows, and insulated roofing are a few options.

Most of these projects you can do yourself, but hire a professional for large and/or dangerous jobs. Be sure to do your diligence and research the contractor before signing any contracts—you never know what might show up in a background check, and it would be a shame to see your upgrade turn into an upset.

Home Upgrades that Add Value

The best upgrades are the ones with the biggest return on investment. Whether you’re looking to sell, build long-term equity, or simply pass the time, here are a few examples of renovations that can make homes more expensive.

- Replace old hardware. Replacing outworn faucets and doorknobs in the bathroom and kitchen can make your home look cleaner and more up-to-date. Choose one type of metal and keep it consistent throughout the space for a cohesive aesthetic.

- Get rid of old grout. The grout lining your shower is porous, which makes it pretty difficult to clean as time goes by. If your tub is looking a little lackluster, remove loose grout with a putty knife and squeeze a fresh application in its place to make it shine. Bonus points for upgrading the tile backsplash while you’re at it!

- Repaint the front door. Enhance the curb appeal of your home by repainting the front door. Bold colors like teal are trending right now, but even a traditional tone will make the property look newer by concealing the toll of time.

These upgrades are cost-friendly and when it comes time to sell your property, they can help you drive a much higher asking price.

What home improvements are you picking up during quarantine? Let us know in the comments below.

Kaelee Nelson

Kaelee Nelson received her Master degree with an emphasis in Digital Humanities and pursues her career as a writer in San Diego, currently writing for 365businesstips.com. She enjoys informing readers about topics spanning industries such as technology, business, finance, culture, wellness, hospitality, and tourism.